By Oyaol Ngirairikl, Pauly Suba and Skyler Obispo

The food and beverage sector of the wholesale industry is a multi-million-dollar one in the islands and caters to the various tastes and ethnic preferences of the melting pot of restaurants and catering services large and small, and residents in the region.

But wholesalers and their distribution networks also operate across the gamut of business sectors from construction to household goods, to healthcare, supplying everything from steel and cement, to staples such as cleaning products and drugs.

The distribution chain also has room for specialized wholesalers that are small businesses in the regional market.

Guam Business Magazine: Are there any emerging trends in the wholesale industry that you’re capitalizing on?

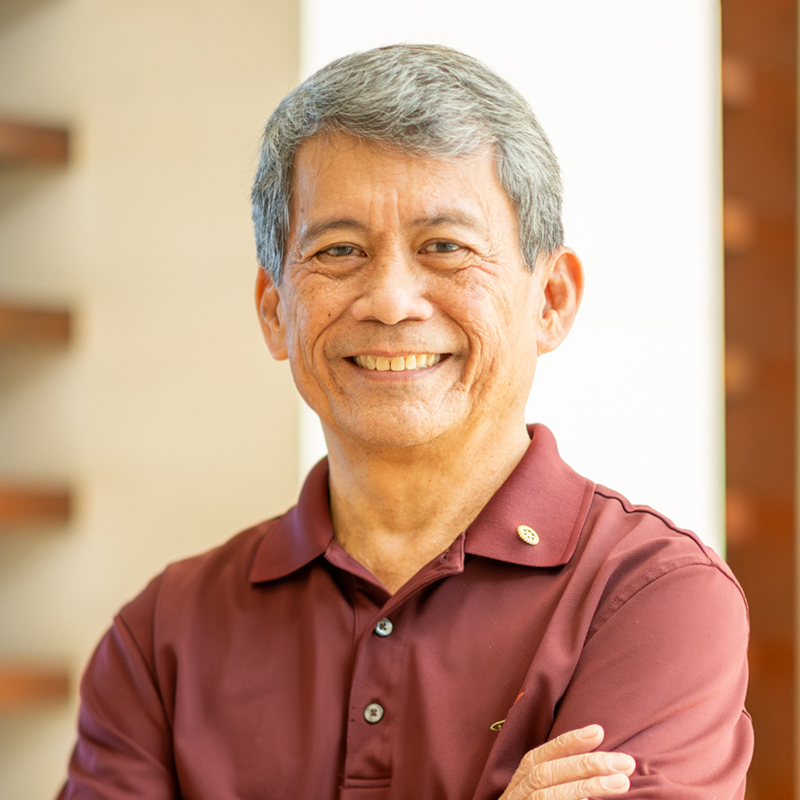

Marcos Fong, CEO of Coca-Beverage Co. (Guam), Coca-Cola Beverage Co. Micronesia and Foremost Foods Inc.: The two main factors that determine the price on the shelves are the cost of goods and transportation. Unfortunately, both are on the rise. This creates huge pressure on the distributor as we attempt to manage the input costs.

James S. Herbert III, general manager, Triple J Five Star Wholesale Foods Inc.: The most concerning trend in the wholesale industry currently is inflation. We are trying our best to combat that and provide more value to our customers.

Hermie S. Queja, general manager, Micronesian Brokers Inc.: Consumers want products that are good for the planet; packaged food items labeled with a sustainability claim [like] sustainably sourced, responsibly produced, eco-friendly packaging. Consumers want health foods [like] better-for-you foods and drinks, products with higher protein and less sugar content.

Christopher P. Sgro, general manager, PDC Wholesale: Over the past two years, non-alcoholic beverages have become a significant growth category for PDC Wholesale. Our recent acquisitions of C20 Coconut Water, Prime Hydration, Alani Energy, Boss Coffee, OKF Beverage, Homegrown Juice, and McCoy Juice reflect our commitment to staying ahead of industry trends. While the beverage market is highly competitive, consumer demand for healthier alternatives with great taste continues to drive innovation. We are constantly evaluating emerging brands and products to align with evolving consumer preferences.

Thomas G. Shimizu, general manager, Ambros Inc.: [Throughout the islands] the trends are similar, but because of the ability to get on the internet, the lag in trends that we used to see in the past has basically disappeared. In lower income areas, we see value brands increasing.

Joseph C. Vitug, general manager, MD Wholesale: We’ve always been open to a lot of anything that comes out. Lately we’ve been able to tap into hospital laboratory supplies. As far as innovations, things just come along, [and] we always entertain any new stuff.

The one that’s going to be coming up and be implemented sometime in August will be a new method of the FDA tracking medicines … They’re trying to identify or stop any fake or any counterfeit medicines. It seems like that thing has been going around, not only with the nation, but proliferated, especially within the region.

GBM: How has consumer demand shifted in the past year, and how are you adapting?

Herbert: With the slow recovery of tourism, consumer demand has shifted with the decreased occupancy of the hotels and the slowing of business within the restaurant sectors. All consumers are much more cost-conscious.

Queja: With consumer preferences evolving rapidly, adaptability is the name of the game today. It’s essential for wholesalers to adapt to evolving consumer preferences and embrace these changes to stay ahead. The future of food distribution is one of innovation and responsiveness. Fortunately, a strong robust partnership with our suppliers keeps MBI informed and ahead of industry trends.

Sgro: Consumer demand has not shifted significantly at the direct-to-consumer level, but we have observed increased demand for value-added services among our On-Premises establishments, particularly in the meat and produce sectors. Our meat processing division has achieved consistent year-over-year growth, now averaging 50,000 pounds of processed meat per month, while our vegetable processing operation processes an average of 10,000 pounds of produce monthly. These services enable businesses to streamline operations by reducing preparation time and minimizing waste — key advantages given the ongoing challenges in retaining skilled labor across the island.

Vitug: Every year it’s a different thing [the consumer] needs. It all depends on what [things are in demand]. How we cope with that — we try to stock up on things based on the trends, but we kind of miss that because there’s a new thing that suddenly became in demand. [If] there’s a new type of flu or some type of [virus] they need kits to test for those things.

GBM: Are you seeing a growing preference for generic or private-label products over branded items?

Herbert: I’m sure at the retail level, there is certainly a growing preference for generic/private-label products as consumers try to stretch their dollars.

Sgro: Consumer purchasing behavior has shifted toward value-driven choices, with less emphasis on brand loyalty. We have seen an increase in demand for generic and private-label products that offer high quality at a competitive price. Customers are now more willing to explore alternative brands that fit within their budgets, making product diversification a key aspect of our strategy.

Queja: Yes and no. There are pros and cons. Private-label products are across the grocery spectrum. Price is a benefit. COVID-19 catalyzed private label growth while inflation and a “shrinking consumer wallet” forced shoppers to adapt. Supply chain disruptions during the pandemic led to many shoppers trying private brands when national brands were not available. Private label products have to be taken seriously. However, consumers still want the comfort, security, and value of a national brand. Taste and quality make a difference. Manufacturers have to do periodic product improvements to keep the brand contemporary without distorting its fundamental promise. Consistent investment in product improvements enhances a brand’s perceived superiority, increasing the brand’s sustainable price premium over the competition.

Vitug: There’s always been that trend as far as generic products. As soon as the proprietary rights [for drugs] are finished for that specific amount of time, the generics start rolling out. It’s good to get the generics; it’s going to make that type of medicine or any product more accessible and affordable. It’s a psychological thing. People think a generic is weaker, but it’s all the same. The Food and Drug Administration is not going to approve it, if it's not as potent as the branded items.

GBM: How is the tourist market impacting the demand for your products?

Fong: The tourist market has a direct impact on our product demand. With over 700,000 visitors in 2024, tourism does help drive sales of beverages such as bottled water, sodas, and energy drinks. So, fluctuations in tourist arrivals — including those caused by the COVID-19 pandemic and recent storms — can lead to reduced demand. As tourism recovers, we are seeing a gradual rebound in sales linked to visitor activity.

Herbert: As stated, the slow tourism recovery definitely impacts demand for our products. Many customers are buying the same products but less of them.

Queja: We’ve seen a significant decline in certain areas of our business. Items which were doing well in the gift shops and hotels have been impacted.

Jesse A. Santos, general manager, D&Q International Distributors: Prior to the pandemic when visitor arrivals were surging, tourists who visited our island markets looked for products seen on social media that could only be found in the U.S. and at reasonable prices. SPAM Garlic, Kraft Easy Cheese spreads, and Kellogg’s Cinnabon cereals, just to name a few, were quite popular for Korean tourists back then. Since the pandemic which saw the decline of visitor arrivals, sales of these products have dropped significantly. The decline of tourists has had a broad impact on the island market economies with the number of jobs that it created, and income derived from this industry that if we were able to maintain, it would have given our island residents a better means to handle the high prices that have come about with the worldwide inflation.

The visitor industry is one of the largest, if not the largest economic driver for our island markets. Without the revenue and jobs that it brings in for businesses and taxes to help maintain and improve government services and infrastructure, we may see a greater negative impact on our island life. We remain hopeful that tourism will rebound and allow our residents greater income opportunities and government finances to further improve. This will help spur greater consumer spending.

Sgro: The gradual recovery of Guam’s tourism industry continues to influence the food service sector of our business. With fewer visitors dining out, demand for wholesale products has softened. While this presents challenges, we are adapting by diversifying our product offerings and working closely with customers to identify emerging opportunities.

Shimizu: Sales to customers that serve the visitor industry are improving year over year, but have not returned to pre-pandemic levels. The areas that rely heavily on the visitor industry have very similar challenges.

Vitug: Our main customer base is the local people. A good number of the local population went off island, and at the same time some of them that are here lost their jobs. If they did not lose their jobs, they had to cut down on their working hours and their income was impacted. Back then [consumers] would go into our retail stores and buy whatever they need. Now they’re very, very cautious.

GBM: Are there any seasonal trends that significantly affect your business?

Fong: Annual events play a key role in our operations. Foremost Foods Inc. and Coca-Cola Beverage Co. Guam take pride in participating in events like Guam’s annual Liberation Day Parade in July, cultural festivals, sporting events, and holiday celebrations which significantly boost demand for beverages. These events provide opportunities to participate in the community as corporate citizens, as well as showcase our diverse product range, from sodas to specialty drinks. Additionally, peak tourist seasons can help drive higher sales volumes.

Herbert: Of course, holidays significantly affect our business in a positive way.

Queja: There was a time when businesses could forecast a drop in sales for certain months based on the ebb and flow of tourist arrivals. Today it’s not so much seasonal trends, but what happens when our islands suffer a direct hit from a typhoon.

Santos: Our products under E&J Gallo Wines, Oreo cookies from the U.S., and Dole packaged food products do exceptionally well during the holidays throughout the year, but especially during the year-end months. Our island culture is tied to gatherings of families and friends and of course eating. … If we are talking about tourism, we have seen dips in the Spring months and then it ramps up towards the end of the year and carries into the new year when it is colder in our source markets of Korea and Japan. Our product sales into the hospitality industry would follow the trend.

Sgro: Fluctuations in the national produce supply chain impact our operations on Guam. During colder U.S. winters, crop damage and delayed growth can result in shortages and higher prices. However, current warmer temperatures in California, Arizona, and Mexico are improving growing conditions, leading to increased availability and price stabilization for key produce items such as leafy greens, berries, citrus, and tomatoes.

Shimizu: Most seasonality for our products follows the visitor industry, with higher consumption during the peak travel months. Vitug: The main one would be the flu. The flu season is always very challenging for us. Sometimes we don’t bring in enough of the vaccine. It all depends on how the customers will order from us. And then all of a sudden there’s a bigger outbreak — we don’t realize or they don’t realize.

GBM: How has the rise of e-commerce influenced your wholesale operations?

Fong: E-commerce presents a growing opportunity for us to expand our reach. While our market remains predominantly brick-and-mortar, we are leveraging digital platforms to advertise and connect with customers. This includes exploring partnerships with local online grocery stores and delivery services to make our products more accessible. However, logistical challenges such as shipping delays remain a consideration due to Guam’s remote location.

Herbert: The rise of e-commerce has influenced our wholesale operations in a positive way. We have a complex system of inventory management and replenishment based on past sales history. This is extremely important due to the long supply chain that we deal with on Guam. We also use online ordering with some of our vendors and hope to create an e-portal for our customers to use as well.

Queja: Traditional distribution models, based mainly on bricks and mortar stores, are giving way to modern solutions, such as e-commerce and online shopping platforms. Digitization of the ordering process is an area of interest. The future of wholesaling must constantly adapt and invest in innovation to meet the expectations of the modern consumer. Embracing e-commerce is a necessity today.

Santos: We recognize that on-line shopping is available to Guam, the CNMI, and other island markets in the region, just like other countries in the world. Consumers may use this option to purchase products that they may not find regularly in local stores, or when new products are launched stateside, as they usually take time to make their way into our markets after the domestic market determines their demand. Despite this, we still see that a majority of shoppers are buying locally, especially for perishables and frozen items, since it is difficult to ship in small volumes and keep temperature safe to consume.

A small number of our retail partners in the region have ventured into e-commerce which allows shoppers the convenience to purchase products on their websites and be able to skip the lines and pick up their merchandise curbside or utilize one of a handful of new businesses which tailor to delivery services.

We have a great marketing team who have done a fantastic job with our social media product pages for Guam and Saipan. Their work with local key influencers has positively impacted our business through communication of new product benefits to local shoppers, consumer promotions with our retail partners, and other fun consumer interactions. All this is done to try and keep the purchases of our products local and recirculate those funds in our local economies.

GBM: Are you experiencing any challenges in hiring or retaining skilled labor?

Fong: Yes, like many industries in Guam and Saipan, we face challenges in hiring and retaining skilled labor. We pride ourselves in providing our employees with a good working atmosphere, but we are also struck by the increasing competition for talent in what looks like a shrinking pool of skilled employees who have the talent and the desire to excel. High costs of living and limited housing options further complicate recruitment efforts. We are addressing these challenges by offering competitive wages, training programs, and career development opportunities to attract and retain employees.

Herbert: Absolutely. Hiring and retaining skilled labor is one of the most challenging aspects of business right now.

Queja: Finding good, reliable, and dependable workers is a challenge and if you have any in the company you do your best to retain them.

Santos: Since the pandemic, many people feel that a large number of our island residents had left for greater opportunities on the U.S. mainland. It appears that many of them were qualified skilled workers, which made it difficult to replace and contributed to the shortage of workers on Guam. In the CNMI, where the economy seems to be struggling more than Guam, our team has observed further outmigration of families in the past year. D&Q has had periodic challenges with filling vacancies, but it seems to be more stable lately, at least for us. We have a great team in Guam and Saipan. We do our best to retain employees through team building activities, training, and instilling the importance of work/life balance.

Sgro: At present, we are fortunate to have a dedicated and stable team at PDC Wholesale. … To support retention and engagement, we invest in their professional growth and continuously seek opportunities to enhance our company culture, ensuring a positive and rewarding work environment.

Shimizu: Absolutely; we are competing with both the federal and local governments as well as stateside companies. Vitug: There’s nothing stopping our employees looking for a greener pasture. That’s the challenge we have to work on locally. It’s a matter of how you treat your employees.

GBM: How are you addressing supply chain disruptions or delays?

Fong: Supply chain disruptions are an ongoing challenge due to Guam's geographic location. Post-COVID-19 shipping delays have largely stabilized but remain unpredictable at times. We work closely with shipping companies to plan ahead and maintain buffer stock. However, once a shipment is missed due to delays or port congestion, replenishing inventory takes time. This reality underscores the importance of precise forecasting and contingency planning.

Distributors who can leverage efficiencies in logistics will benefit from lower transportation costs. Product sourcing from countries beyond the U.S. may become more mainstream as distributors and consumers, alike, search for more cost effective and quality products.

Herbert: Fortunately, we have not encountered too many supply disruptions. We work very closely with our transportation and supply chain partners.

Queja: Supply chain disruptions are less frequent. For one of our suppliers the disruption is due to an ongoing installation of new manufacturing technology to improve production efficiency.

Santos: Unlike living stateside, our island markets rely heavily on products to be shipped in from many different sources, but mostly from the U.S. mainland. This is unique to our island way of life. While there have been periodic shipment delays and unforeseen supply chain disruptions, we try to get ahead of this as best we can by carrying a certain amount of additional inventory. This can only be done for products with longer shelf life.

Sgro: To mitigate supply chain disruptions, we maintain strong partnerships with multiple vendors across the U.S. and internationally. By leveraging multiple shipping options and maintaining open communication with our suppliers, we proactively manage potential delays. Our 50,000 square-foot warehouse provides significant chilled and dry storage capacity, allowing us to maintain inventory levels that cushion against supply fluctuations.

Additionally, we collaborate with other local distributors — many of whom are also our customers — by supplying products they may be unable to source due to inventory gaps or shortages. In turn, they provide the same support when we face similar challenges. This cooperative approach helps ensure that our respective customer bases have access to essential products, even during supply chain disruptions.

Shimizu: We have adjusted inventory levels to compensate for delays.

Vitug: We’re pretty much the one that supplies the end user. What we normally do when that happens, we have to special order [through air freight] small amounts of those special items that we have to bring in to fill the emergent gap for medical institutions. A lot of the things we bring [through the port] are our bulky items and they have a longer shelf life.

GBM: Are you investing in new technologies to streamline your business processes?

Fong: Yes, we continuously invest in technologies that enhance efficiency across operations. For example, we use inventory management software to track stock levels accurately and reduce waste. Given Guam’s remote location, we are also exploring automated ordering systems to minimize errors in procurement. These investments help us adapt to challenges like shipping delays while improving customer satisfaction.

Herbert: We are constantly trying to take advantage of new technologies. We are currently evaluating a new software system to streamline our business processes.

Queja: MBI made a business decision to upgrade its WMS (warehouse management system) several years ago. Today it’s more a matter of replacing equipment and transitioning to cloud-based setups. Staying relevant as an industry player means fostering a culture of ongoing improvement and learning.

Santos: For several years now, our sales teams in Guam and Saipan have had the ability to work up orders electronically in the field and transmit them to our order processing teams in the head office. With many products that we can offer, this has increased our time spent with customers and allowed us to see more customers, versus hand delivering those orders back to the head office after the morning and afternoon sales visits. We recently converted to a new ERP system called SAP that is used by many leading companies worldwide. This has allowed us to closely monitor our inventory turns, financials, etc. With this upgrade, we now have the option to look at software add-ons. We are looking into a warehouse management system that could help us further improve operational efficiencies by allowing us to better plan out fulfillment of customer orders and rotation of products to minimize losses.

Sgro: We are in the final stages of implementing a new barcode product scanner system to enhance our inventory management. With thousands of SKUs spanning various categories, this technology will enable real-time inventory tracking and precise stock location management within our warehouse.

Shimizu: Yes, in all areas of the business.

Vitug: We are actually working on a new inventory system that can accommodate a wider range of products, to include specialty items.

GBM: What products are flying off the shelves right now, and why do you think they’re so popular?

Fong: Coca-Cola and Sprite remain perennial favorites among both locals and tourists due to their global recognition and refreshing taste that we believe is suited for Guam’s tropical climate and goes perfectly. Additionally, bottled water sees high demand year-round due to the warm weather.

Herbert: Cheaper products and products that have added value.

Santos: We represent many fast-moving consumer products, but one that stands out is SPAM. Since its introduction during World War II, SPAM has been a staple in many homes throughout our region. It is quick and easy to prepare and it is seen as comfort food when times are tough or when having to cope with the aftermath of storms that come through. We have a broad range of items, which affords us the ability to remain relevant in our island markets by bringing quality products and adapt to consumer needs. We are especially proud of having introduced Gain laundry detergent, Luvs diapers, and numerous other popular products into our island markets for many years behind strong partnerships with our retail customers.

Sgro: Eggs! Eggs remain in high demand as we continue to secure a limited weekly supply amid the nationwide shortage. The U.S. faces a deficit of 50 million – 60 million egg-laying hens due to ongoing Avian Influenza outbreaks, keeping supplies critically tight and retail prices elevated. While experts anticipate price relief by mid-year if no major outbreaks occur, the peak flu season in March and April could further strain supply. Specialty eggs (organic, cage-free) remain significantly more expensive due to production challenges, regulatory requirements, and higher disease vulnerability.

Shimizu: Health and lifestyle as well as functional products have been growing.

Vitug: A lot of diabetic supplies. In our region, [diabetes] is one of the high-risk diseases that’s been around. … A lot of the maintenance medicines for [diseases] like high blood pressure. Those are constantly going out and of course antibiotics.

GBM: Are there any local or regional products that are performing exceptionally well?

Fong: Yes, the post-workout recovery drink Core Power is gaining popularity among fitness enthusiasts on Guam and Saipan. Its growing popularity reflects what we believe is an increasing health-consciousness among residents.

Herbert: While we do not carry many local products, we have had success in providing local produce from our farm on Tinian to many of our accounts. We are also supplying a new line of grass-fed lamb and venison from New Zealand known as “Pasture Fresh.”

Santos: Universal Robina Corp.is the leading snack brand out of the Philippines with well-known products such as Jack ‘N Jill Chippy and V-Cut potato chips. We specifically import only those products that are compliant, which includes labeling, for U.S. markets by meeting federal regulations. We are actively working on approvals for another popular Philippine product line, and we hope to introduce into our island markets soon.

Sgro: PDC Wholesale is proud to distribute Denanche Drizzle, a locally crafted hot sauce made from hand-picked Guam-grown peppers by Lenny and Pika Fejeran. Additionally, we are one of the largest buyers of local produce, working closely with farmers to bring fresh, locally sourced products to market. Our established relationships allow us to deliver farm-to-table logistics efficiently, offer competitive pricing compared to imports, and strengthen our partnerships with local agricultural businesses.

GBM: Are there any underrated products that customers should try?

Fong: Super Coffee Super Energy is an energy drink that combines caffeine with added protein for sustained energy throughout the day. It tastes great and is a great choice for busy professionals or fitness enthusiasts looking for an alternative to traditional energy drinks.

Queja: Our T.Grand [beverage] products.

Santos: We picked up the Dole packaged goods distributorship recently and look forward to further developing this global iconic brand in our region. Dole is well known for its pineapple products, which are offered in many sizes including food service. What many people do not know is that they also have individual fruit cups and dried mangos from the Philippines which had been out of production for some time and only recently are being reintroduced to consumers in the region. We are delighted to see the distribution and repeat orders contributing to month-on-month growth of these convenient SKUs. You can find these products in most major supermarkets or at your favorite store.

Sgro: We are excited to reintroduce Homegrown Juice, a fresh-pressed raw juice from New Zealand. Packed with nutrients and exceptional flavor, this product has been well-received by consumers. We will be conducting in-store sampling events throughout March and April to showcase its quality and taste to the community.

Shimizu: Elijah Craig/ Evan Williams Bourbons, Dewars Scotch, Ready to Drink Cutwater Cocktails — perfect for entertaining at home.

facebook

facebook

Whatsapp

Whatsapp