Companies see bright spots peeking through a slowly recovering economy

By Oyaol Ngirairikl

In spite of concerns about still-recovering regional economies, a majority of companies participating in the 2024 Bank of Guam ASC Trust Top Companies of Micronesia Confidence Survey say they are fulfilling their expectations. They also anticipate more opportunities for growth in 2025.

The Top Companies of Micronesia is an annual feature of Guam Business Magazine that highlights businesses with an annual revenue exceeding $1 million. The list provides the financial standing of the companies and offers insights into the regional economic landscape in which they operate.

Another aspect of the feature is the survey that asks businesses how their company fared in the past year. Based on their experiences over the past year, Guam Business Magazine also asks business leaders what lessons were learned in the previous year.

Several respondents noted the bright spot of U.S. military construction. Readers will see in the list how local companies that have military contracts have risen in rank.

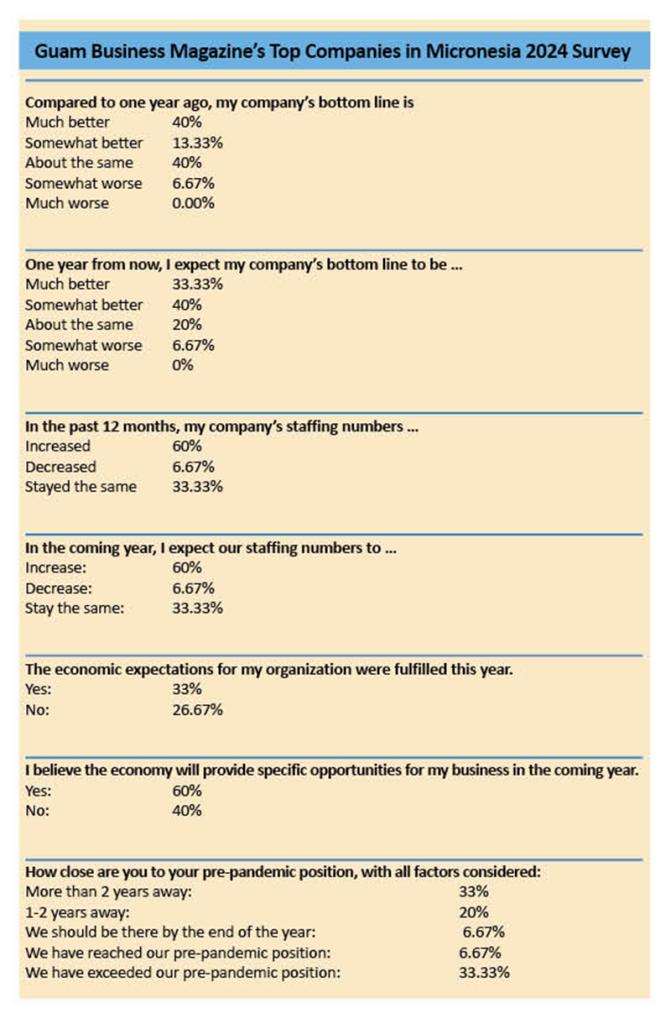

In this year’s survey, more than 73% of respondents said economic expectations were fulfilled this past year and more than 60% anticipate more opportunities to come next year.

Respondents noted that “tourism will continue to recover.” Additionally, opportunities are anticipated in logistics, infrastructure and construction projects. One respondent shares that their outlook is based on continued “federal spending on broadband and Department of Defense facilities.”

The survey indicates a continued trend of optimism and growth — while slower than most wanted — over the past few years. Of course, it didn’t help that after the COVID shutdown, the price of doing business went up with inflation, and then, at least for those in Guam, a typhoon left many businesses without water, power and even communication — some for several months.

Nonetheless, some businesses in the region reported growth with 53% of survey respondents saying they saw an improvement in their bottom line compared to the previous year.

This year, 40% of respondents said business levels were maintained. In comparison, the 2023 survey showed 78% reported improvements.

According to survey respondents, the slow recovery in tourism impacted growth.

Responding to seven survey questions, participants addressed the improvement of their company’s position, with 40% stating their companies are doing “much better,” and 30.33% reporting a “somewhat better” financial status. This marks a trend in slight improvements that started a few years ago:

- 2021: 50% of respondents noted improvements

- 2022: 74.9%

- 2023: 78.5%

An interesting point of comparison is in 2023, 21.43% of respondents said their companies bottom line was worse than the previous year. In 2024, none of the respondents reported worse performance, instead saying business levels were maintained.

Another survey question with responses worth noting was the staffing numbers, with 60% showing increases and 33% saying staffing numbers remained the same. That’s comparable to 2023 responses, which showed 57% of respondents had an increase and 35.7% stayed the same. A majority of respondents reported they are anticipating increasing staffing levels, a couple by as much as 10%. That would be good news for Guam’s economy overall, assuming the labor is available.

In 2023, GBM introduced a new question which also indicated buffered expectations. In the 2024 survey, 39% of respondents either exceeded or expected to exceed pre-pandemic positions. That’s a decrease from the 50% in 2023 but respondents noted very similar concerns about U.S. interest rates and the cost of doing business.

A little over 50% of respondents said they are one year or more from achieving their post-pandemic levels.

facebook

facebook

Whatsapp

Whatsapp